CAPX recently conducted a survey of business leaders from middle-market companies and private equity firms on challenges associated with securing capital for refinancing, acquisitions and growth in the current lending environment.

The survey results are compelling.

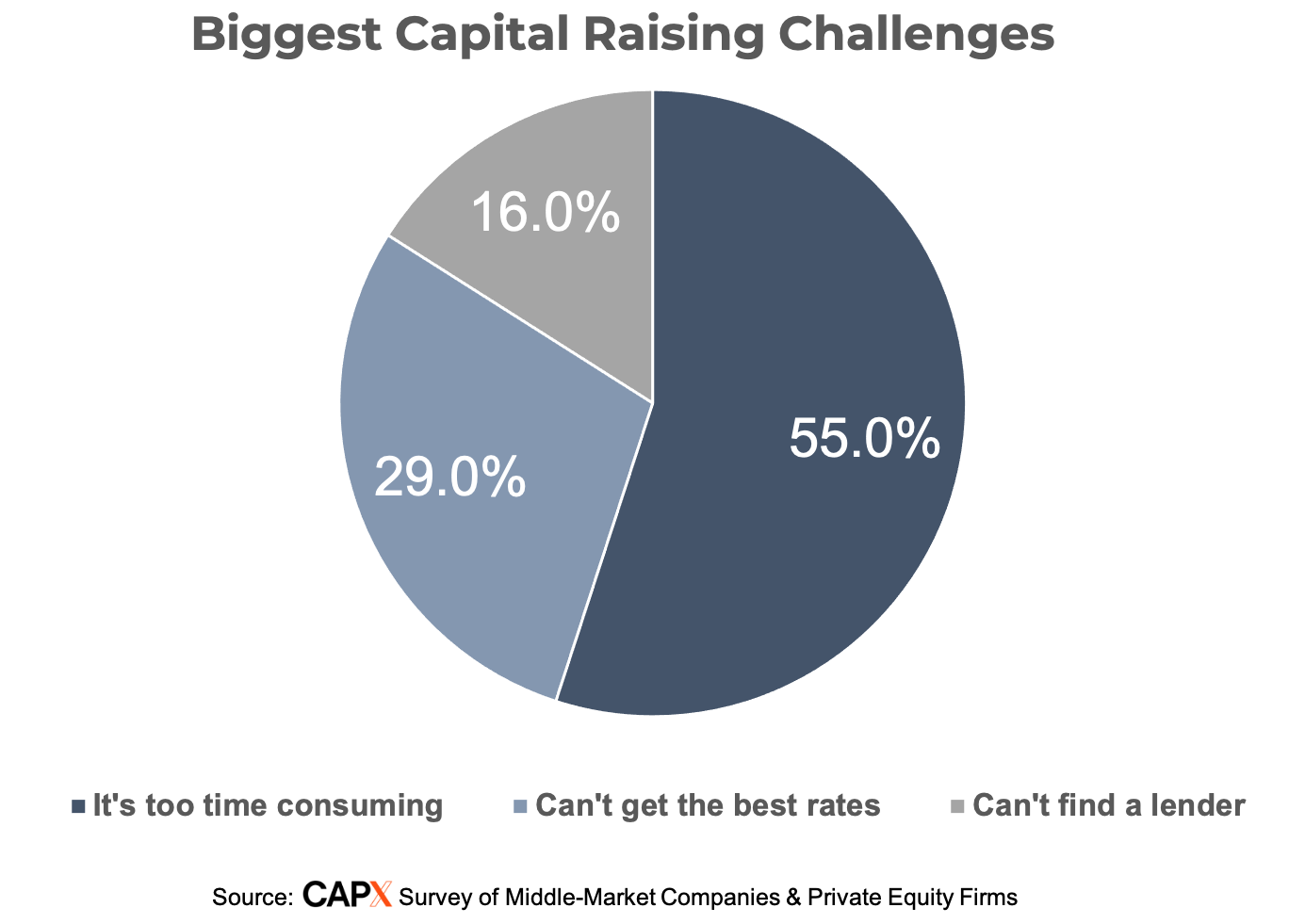

US middle market companies and private equity firms – the growth engine of the US economy – are struggling to get the capital they need in a timely manner. In fact, a resounding 55% of business leaders across multiple industries pointed out that the process of securing capital is too time consuming right now.

Key Takeaways:

- All types of corporate borrowers are struggling to find the capital they need when they need it, which could negatively impact both company and national growth

- The biggest challenge is how long it takes to obtain capital in the current credit environment

- PE firms said their biggest issue was finding a lender

- M&A deal makers were overwhelmed by delays in securing debt financing

- Overall, the survey highlighted the need for US corporate borrowers to diversify their lending options and seek ways to accelerate financing

Timely Access to Capital is #1 Challenge

Finding the right capital provider has always been crucial for middle-market companies and private equity (PE) firms, especially when they are doing an acquisition. But that is especially true right now.

We are likely passing through a once in a decade phase of lower valuations. Corporate buyers with access to capital can take advantage of this unique opportunity to acquire strategic targets and put their company on a solid growth trajectory.

However, finding the right amount of capital with the most competitive structure can be quite time consuming. Add the economic uncertainties and tougher credit standards to the mix, and now you have a process that can overwhelm deal teams at any corporation or PE firm.

We validated this reality in a recent survey we conducted with middle market corporations and PE firms. We asked participants to identify key pain points in the process of finding capital. 55% of survey respondents pointed out that the process of securing capital is too time consuming.

When just finding capital takes up most of your time, you wouldn’t have the time to find multiple options and get the best terms. This was also confirmed in the results of the survey where 29% of respondents mentioned that they cannot find the best rates.

50% of PE Respondents Can’t Find a Lender

Lenders and PE firms have told us that there are deals out there, but the quality is not good. If 50% of PE respondents to our survey cannot find lenders, they must have bad quality deals, right?

Not necessarily so.

There are more than 250 middle-market focused banks and almost 1,000 non-bank lenders in the US. Basically, there is a lender out there for every type of risk. More likely, these PE firms ran out of time, resources and contacts to chase multiple lenders at once. 30% PE firms confirmed as much – they told us it is too time consuming to secure capital.

When debt is the largest chunk of capital you need to complete an LBO in this deal starved market, the quandary for deal shops is to figure out how much time to spend courting that seller vs. chasing those lenders. The reality is that they need to do both. But when you have to spend hours to get feedback from a single lender, you are more likely to lose the auction process before you secure capital.

60% of Middle-Market Corporates Can Find Capital, After Spending A Lot of Time

The majority of middle-market corporates have some form of debt. All of them have a corporate treasury account. So, it is not surprising that corporate business leaders indicate that they have access to capital providers. But when 60% of them told us that it was too time consuming to get capital, even though quite likely they already had relationships with them, it points to the current state of ‘slow-credit’ in the lending industry².

You see, no relationship banker wants to turn down a deal. But their credit committees are not ready to say “yes” to deals that quickly either – there are bank capital issues, portfolio concerns and always the hope to find a better deal to invest that limited capital they want to lend.

Once a middle market CFO starts the capital raising process with a relationship bank, the ‘slow-credit’ often stretches out to a point where the window to reach out to multiple capital providers has closed. The side effect of this ‘slow-credit’ movement? CFOs are often forced to accept terms and pricing they know are not ideal because there is no time to find a better solution. 31% of our middle-market respondents confirmed as much.

Corporate M&A Hamstrung by Slow Lending

Although our survey confirmed that middle market corporate borrowers always found a lender for their M&A deals, a whopping 80% of respondents told us that the process took way too long.

Nothing can motivate an incumbent lender more than the threat of losing an existing lending relationship. The problem is that the CFOs naturally believe that the lender they have worked with for so long will send them a term sheet for their next acquisition right away.

That is so 2021 thinking!

But that relationship focus is dragging on the middle-market M&A processes. Unless the CFOs can quickly broaden their lender outreach, they will continue to face uncertainty in timing as well as the amount of capital they can get from relationship lenders.

CONCLUSION:

Diversification and Streamlined Financing are Key to Successful Capital Raising

If you cannot predict when your lender will tell you how much capital they can give you and at what terms, you need to improve the odds by going to more lenders – hope you have a strong network of national and regional banks, non-bank lenders as well as 4 hours every day to tell your story ad nauseam.

Alternatively, you get on CAPX. We recently helped a manufacturing company obtain term sheets for a $115MM refinancing under a cash flow structure when their incumbent lenders and 2 relationship banks gave them a run around for a month and didn’t give them a straight answer for the request for a cash flow structure. We launched their cash flow deal on CAPX to multiple national and regional banks and within two weeks, got multiple term sheets to club up the $115MM cash flow deal structure.

At CAPX, we have always believed in telling a uniform credit story – at national scale and with the speed of a digital process. We told such a story of a complex roll-up opportunity for an IT Services platform with over 65% customer concentration to over 30 lenders over two weeks and secured multiple term sheets for the sponsor.

No lender calls, no meetings, no networking – uniform credit thesis, digital distribution and rapid responses from lenders.

If you would like to discuss your credit options, click the link below to schedule a phone conversation and learn more about the power of diversification and streamlined financing that are only available through CAPX.

CAPX efficiently supports complex middle-market transactions, no matter how complex they may be.

We recently facilitated a $120 million refinancing for a manufacturing firm, swiftly securing viable term sheets. This is just one example of the many challenging corporate financing situations that CAPX excels at solving. We specialize in securing financing for clients who may not fit within traditional credit boxes.

If you cannot find capital or if your institution’s credit committee cannot provide capital for a client, we often can.

Unlock Opportunities for Your Clients with CAPX

Learn more about our referral program & finder’s fee and discover how CAPX can empower your clients with innovative financing solutions tailored to their unique needs.